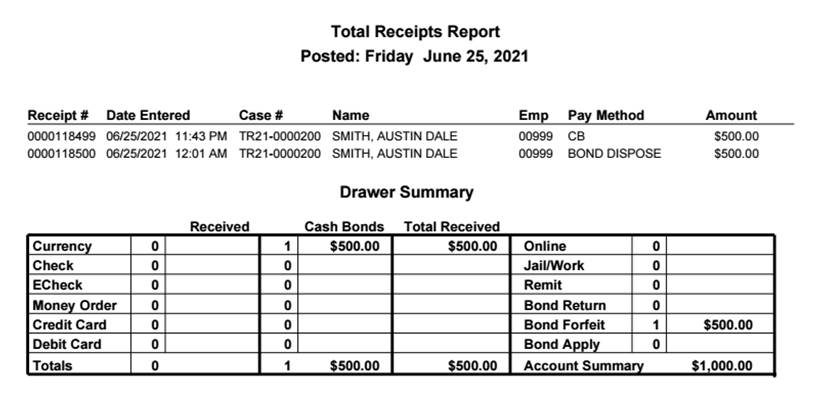

Surety Bonds

Receiving a Surety Bond

Even though no money is initially received, Surety Bonds are taken through the payment screen. Like a Cash Bond, a Surety Bond may be taken on a particular case or may be taken on a Defendant Profile before a case is entered.

Steps

-

Go to the Case (or Profile) on which the Cash Bond is to be taken and click on the Payment Icon.

The Payment Icon

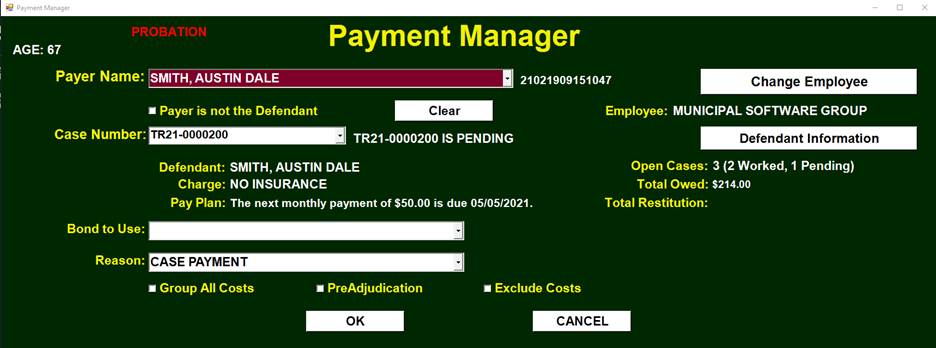

The Payment Manager screen should now appear.

The Payment Manager screen

-

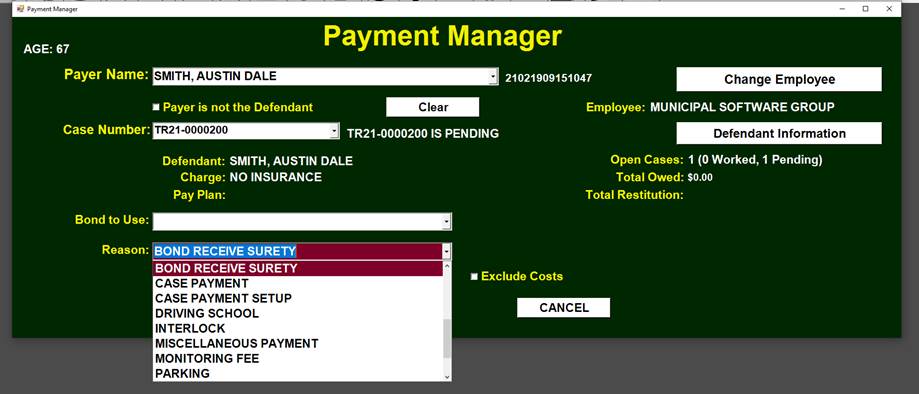

Change the Reason to ‘BOND RECEIVE SURETY’.

Changing the Reason

-

Click 'OK'

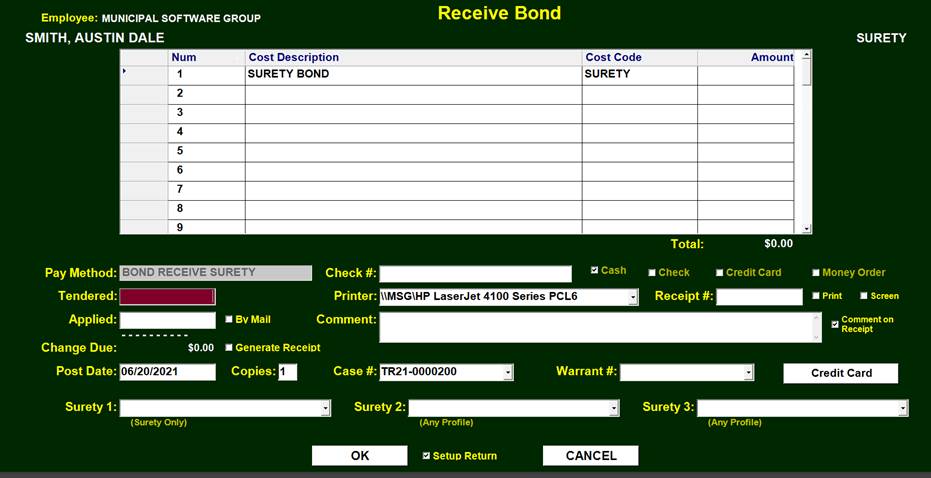

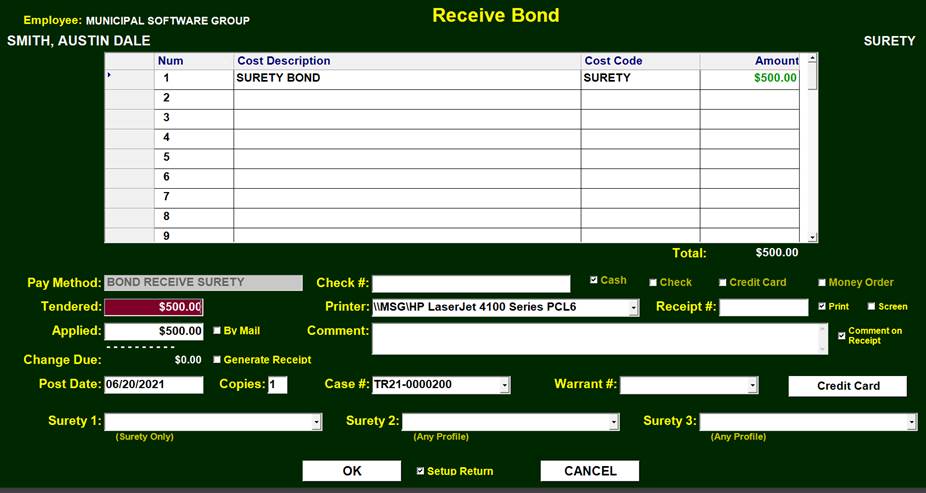

The Receive Bond Screen will appear.

The Receive Bond Screen

If this Defendant had a Bond Amount from a Warrant, that amount would be prefilled into the ‘Tendered’ field.

Otherwise, Enter the amount of the Surety Bond in the ‘Tendered’ field.

Entering the Bond Amount

This amount will be automatically placed in the Applied and Surety Bond fields.

The Bond Amount added to appropriate fields

-

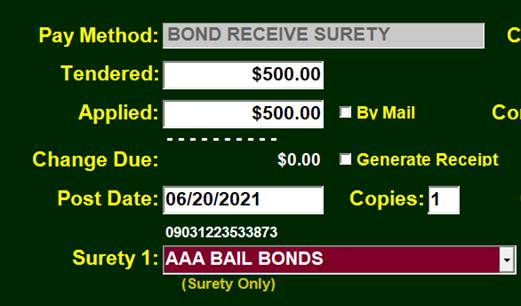

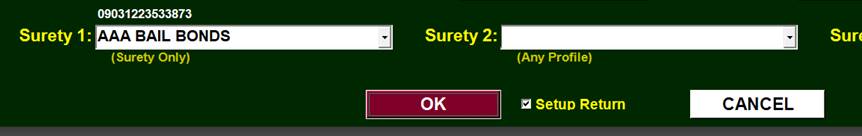

Add the Professional Surety in the Surety 1 field if appropriate. This Surety must first be in the Surety Table. See Adding a Surety Company if needed.

The Receive Bond Screen

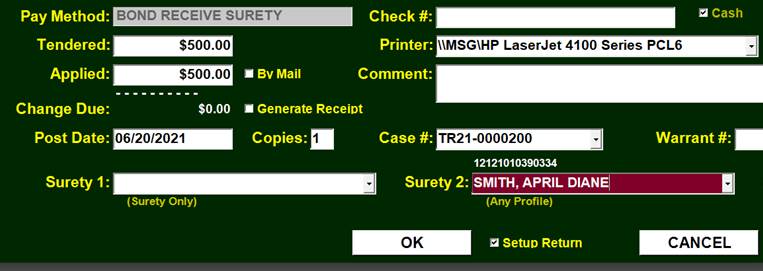

Or add an individual Surety in Surety 2 or Surety 3 fields if appropriate. This Individual must first be in the Profile Table. See Adding a New Profile Record if needed.

The Receive Bond Screen

-

Click ‘OK’ to generate a Surety Bond.

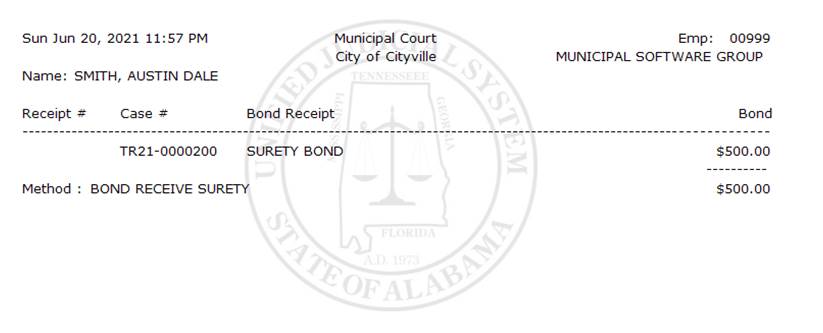

A Surety Bond Receipt is generated.

The Surety Bond Receipt

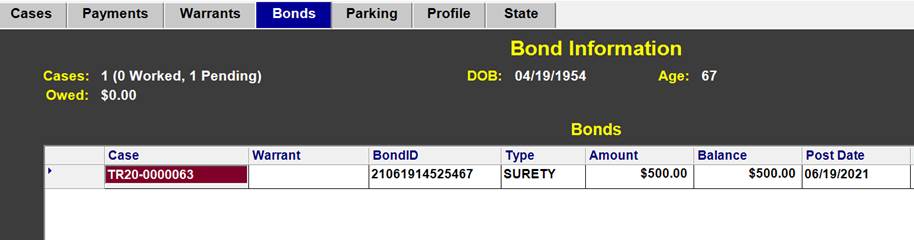

The Surety Bond of $500.00 is now attached to this Defendant and Case. It may be viewed by clicking on the ‘History Book’ and then the Bonds tab.

The 'History Book' icon

Bond information attached to case

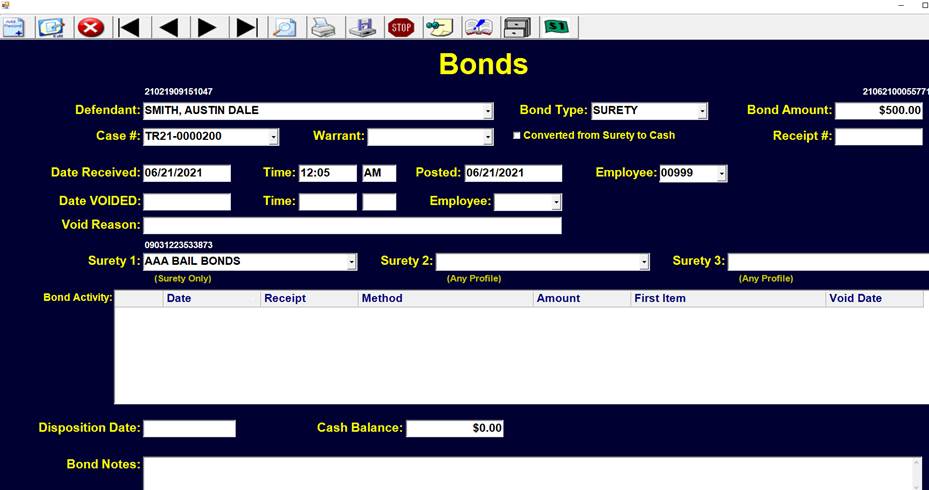

Double clicking on the Surety Bond will display the Bond Record.

The Bond record

Surety Bond Forms

Should the defendant ‘Fail to Appear’ on a case with a Surety Bond, there are a number of forms relating to ‘Conditional Bond Forfeiture’, ‘Bondsman’s Process’ and ‘Final Bond Forfeiture’. These forms require that a Surety Bond record exists for the Defendant. (See ‘Receiving a Surety Bond’)

Go to the Defendant’s Case Record in Cases (Quick Menu  -> Cases)

-> Cases)

OR

Go to the Bond Record in the Bonds (Bond Menu  -> Bond Table)

-> Bond Table)

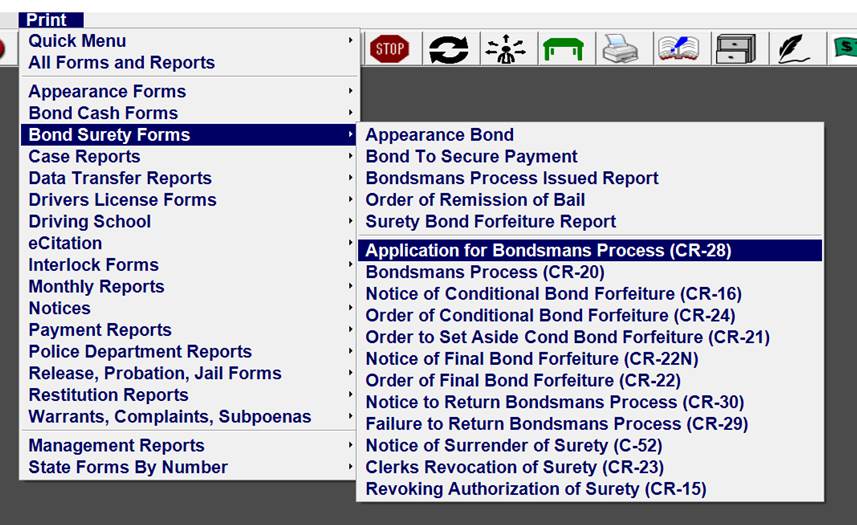

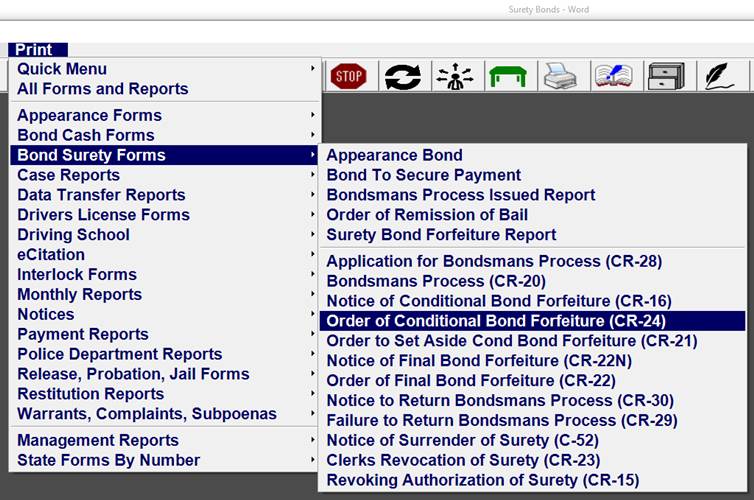

Select the appropriate form from the Surety Bond Forms Menu and press enter. Print > Bond Surety Forms > (desired form)

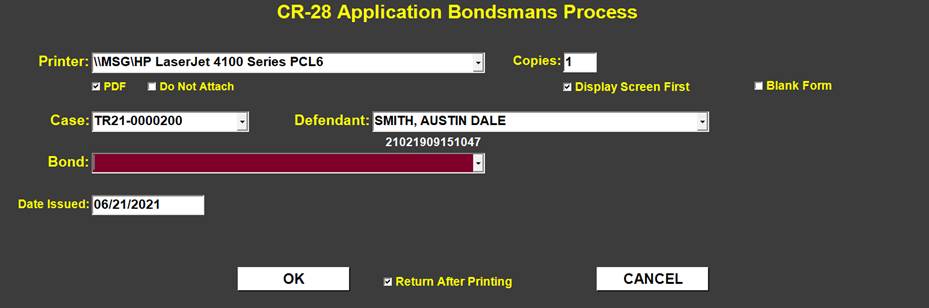

The initial Screen Form will appear with Date Issued defaulted to the current date. This date may be changed if needed.

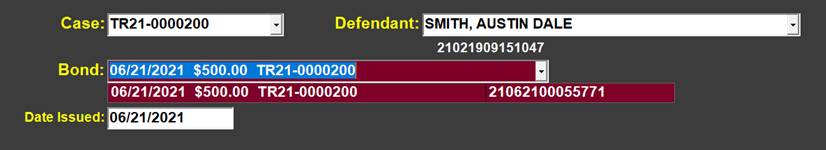

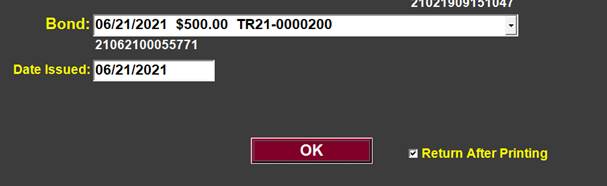

In the Bond Field select the appropriate Surety Bond.

Click on ‘OK’ to Print the Form.

Each of these Surety Forms will have a similar procedure. Some forms have other dates besides ‘Date Issued’ such as a ‘Forfeiture Date’

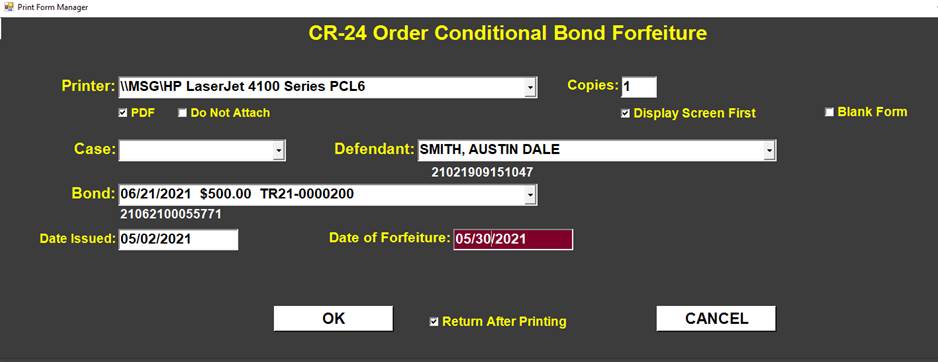

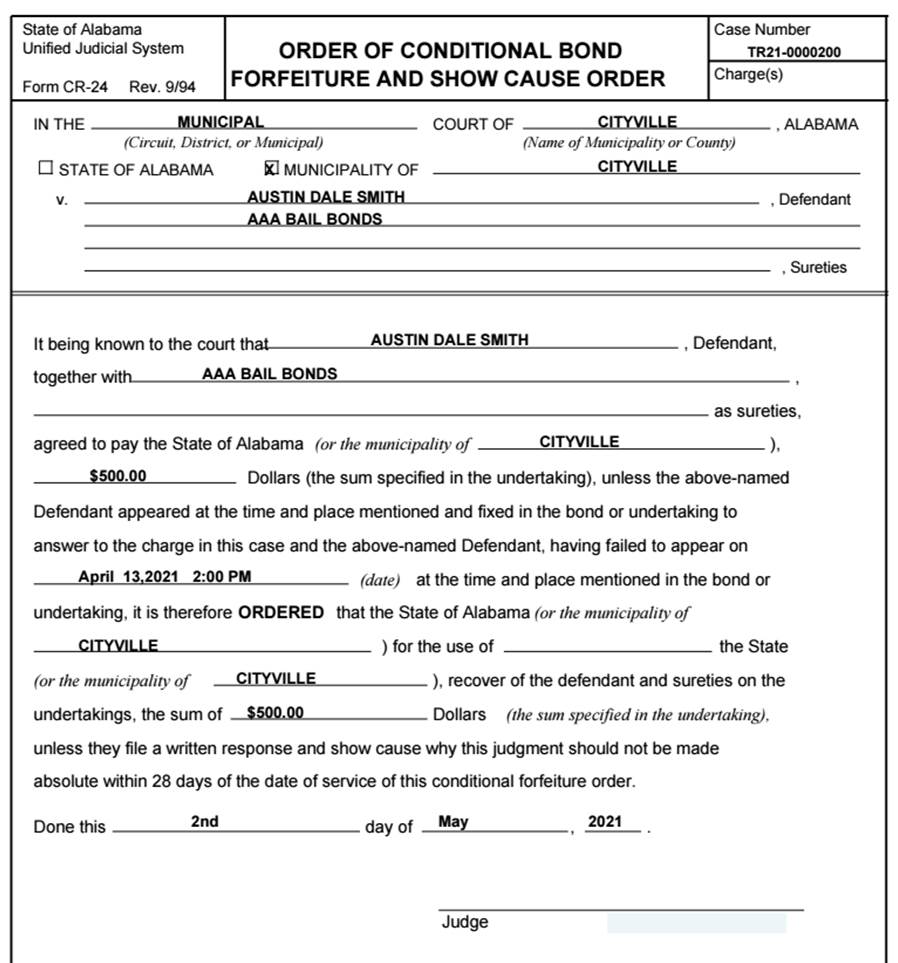

Surety Bond Conditional Forfeiture

Should the Defendant not appear to fulfill the obligation of the surety bond, the court may issue a CR-24 Order of Conditional Bond Forfeiture.

The Date of Forfeiture is setup to be 28 days after the issue date.

The Forfeiture is ‘Conditional’ so that the Surety has an opportunity to respond.

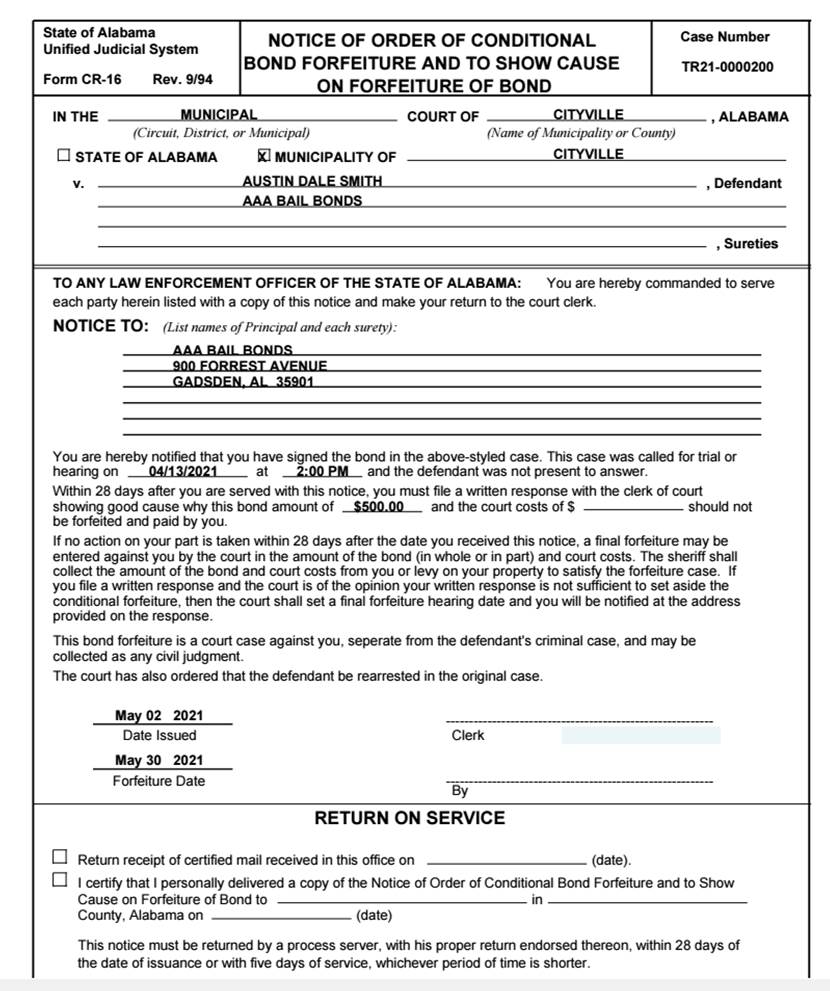

A CR-16 Notice of Conditional Bond Forfeiture would then be sent to the surety.

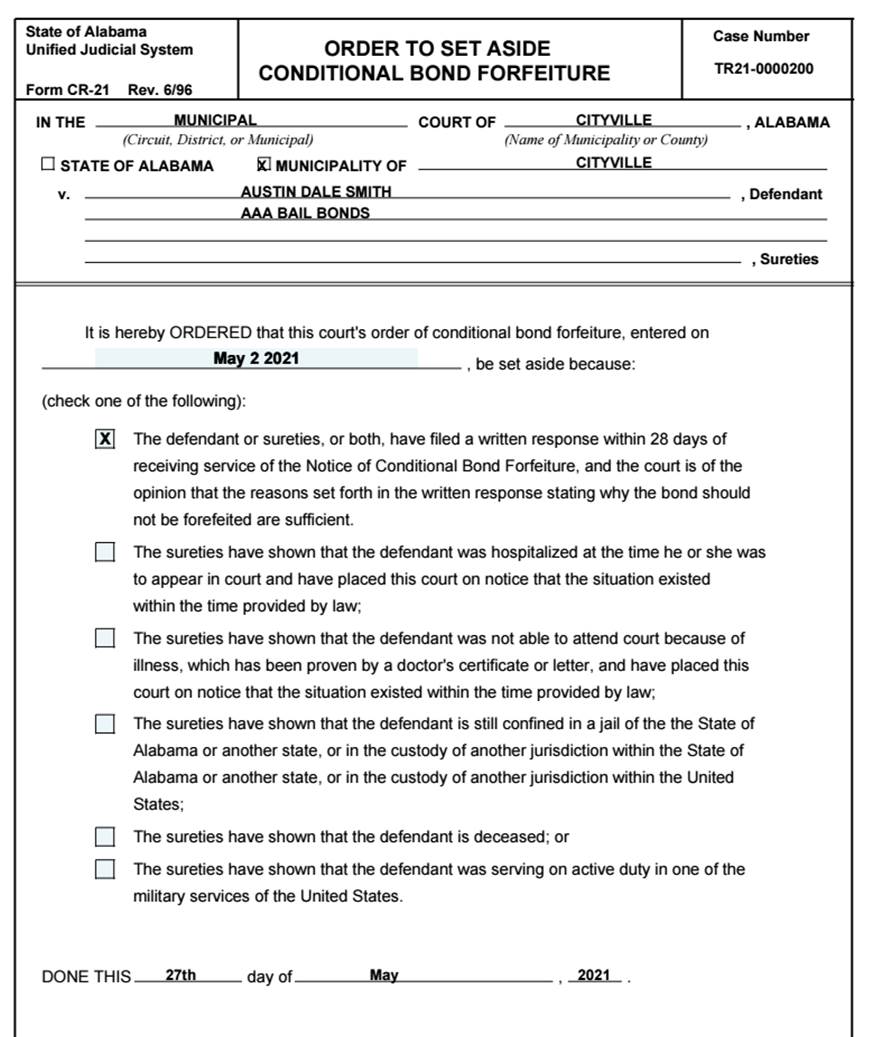

The Surety now has 28 days to Present the defendant or demonstrate a valid reason for not Presenting the Defendant to have the Conditional Bond Forfeiture Set Aside (CR-21)

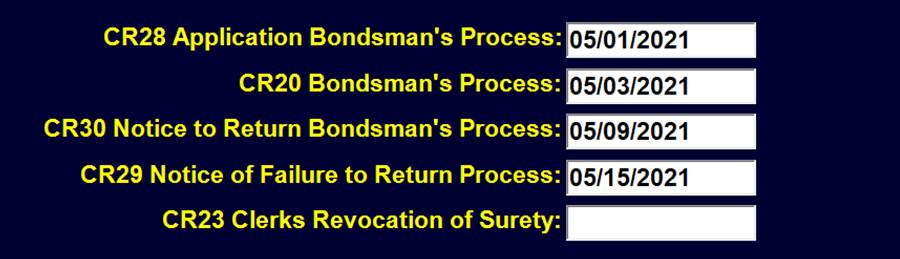

The Dates on each of these actions are entered in the Surety Bond Record.

Bondsman's Process

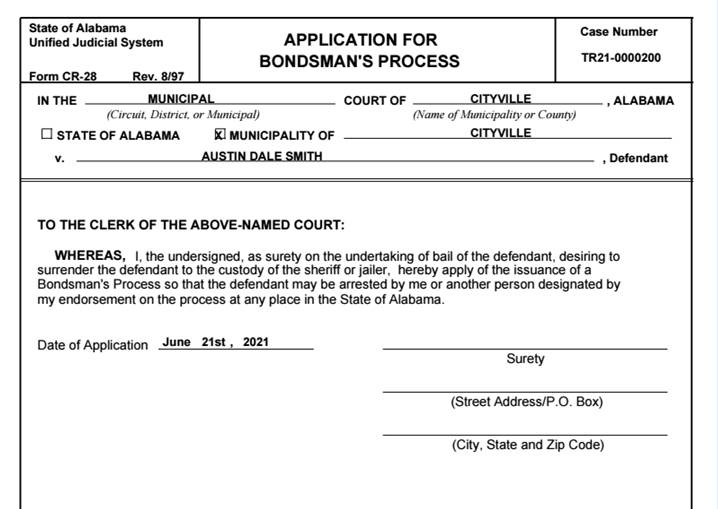

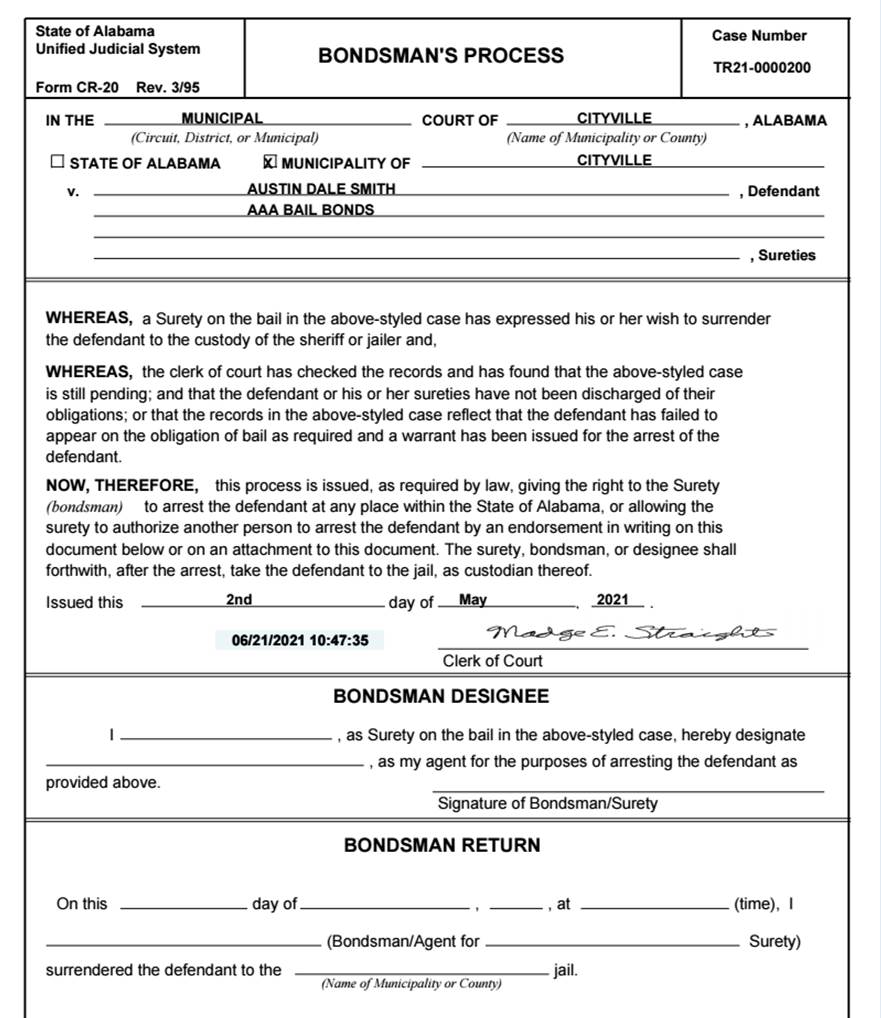

The Bondsman’s Process allows the Surety to locate and arrest the Defendant for a short period of time. The Surety must first complete a CR28 “Application for Bondsman’s Process”.

After the Application is accepted, the actual Bondsman’s Process (CR20) is Printed.

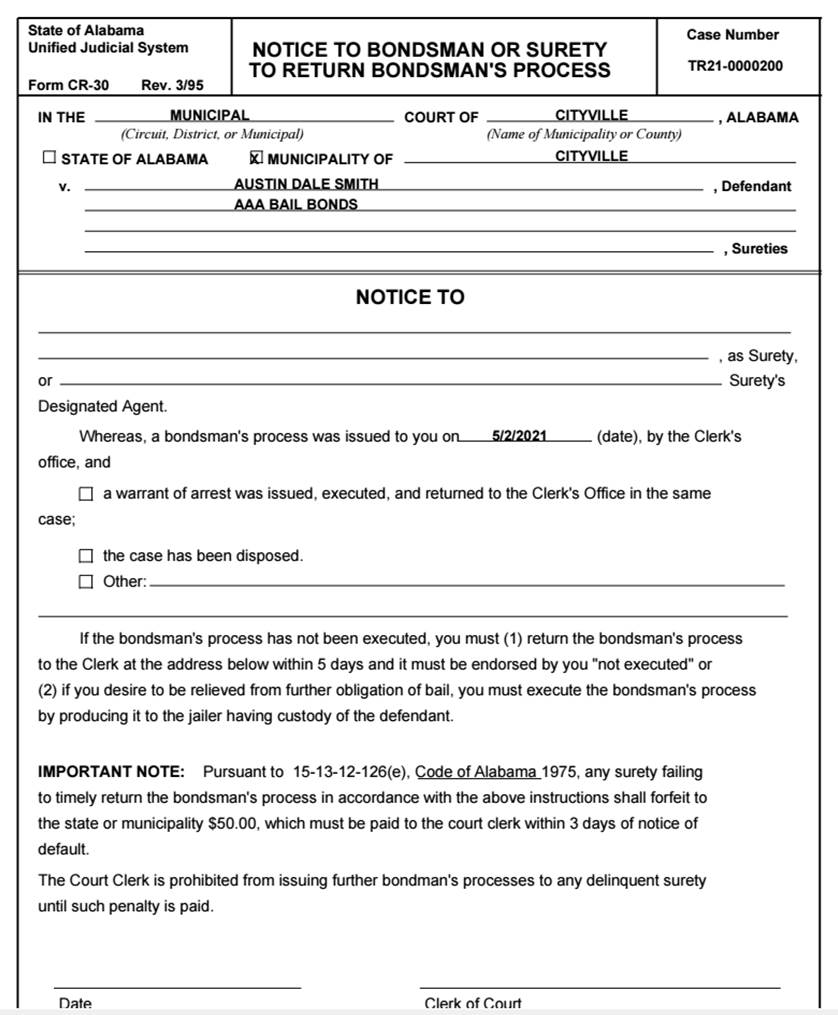

After five days or in certain events, a Notice to Return Bondsman’s Process (CR-30) may be issued.

Clicking the 'OK' button

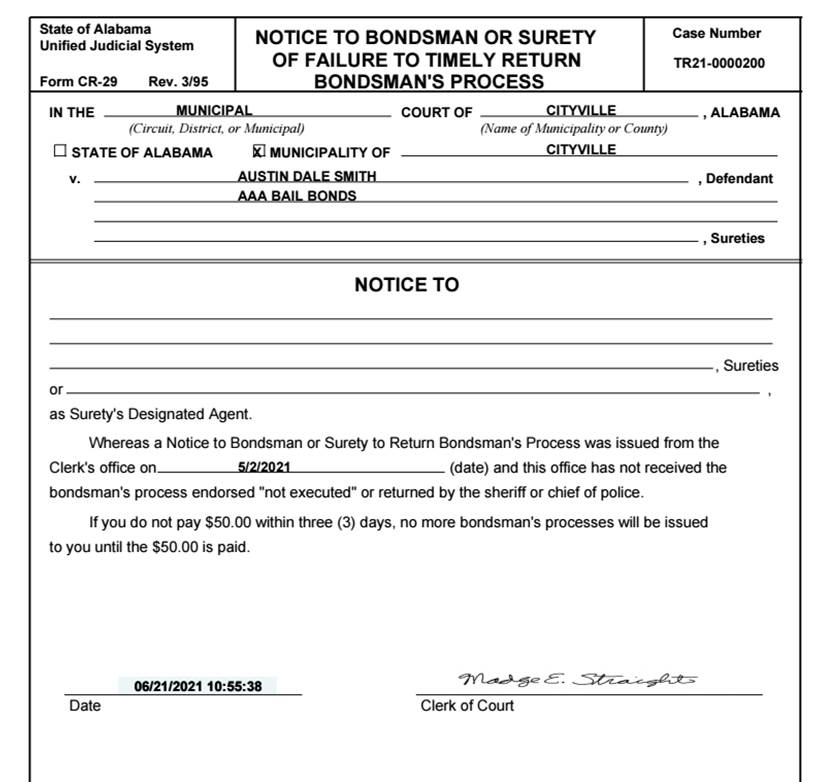

Failure of the Surety to return the process may require a CR29 ‘Failure to Return Bondsman’s Process’ to be issued.

The Bondsman's Process Form

As these actions are taken, the dates are stamped in the Surety Bond Record.

Notice to Return Bondsman’s Process (CR-30)

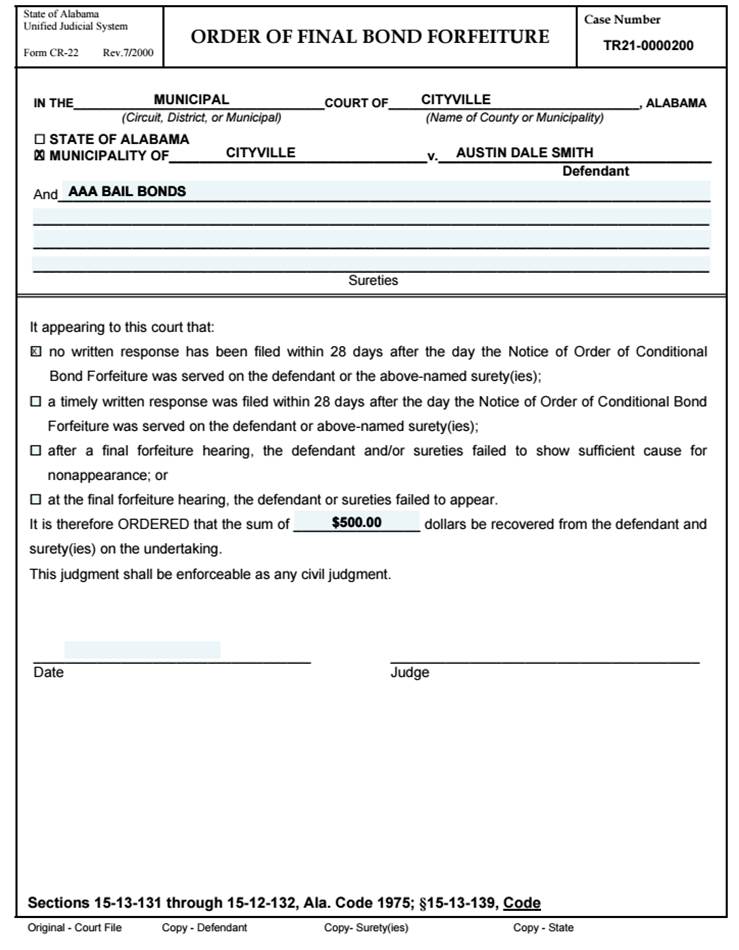

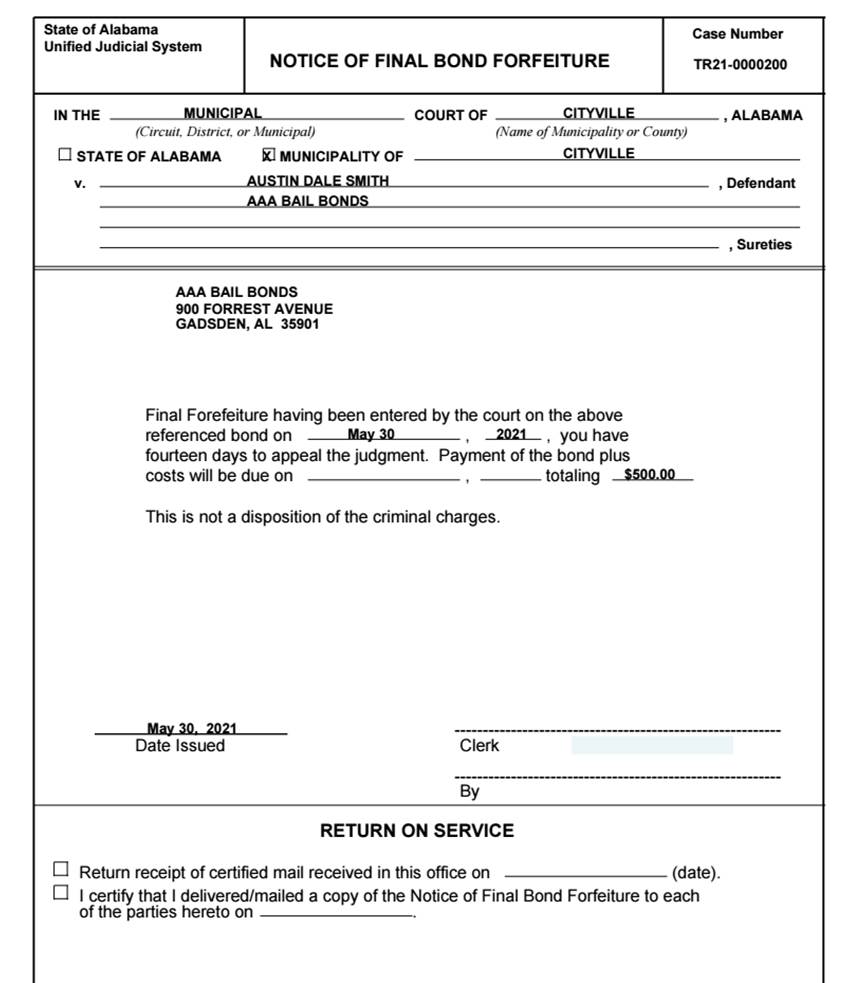

Final Bond Forfeiture

The ‘Conditional Bond Forfeiture’ period is 28 days after it is ordered.

If the Surety does not present the Defendant or demonstrate a valid reason for not presenting the Defendant, the orfeiture will become a Final Bond Forfeiture (CR-22).

A CR-16 Notice of Conditional Bond Forfeiture would be sent to the surety.

The Surety has 14 days to appeal.

As these actions are taken, the dates are stamped in the Surety Bond Record.

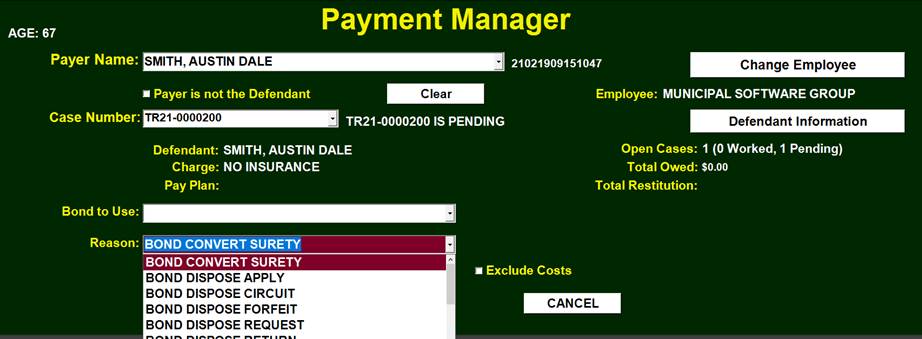

Converting a Surety Bond to a Cash Bond

When a Surety Company pays on a Surety Bond, the Surety Bond is converted to a cash bond and then forfeited.

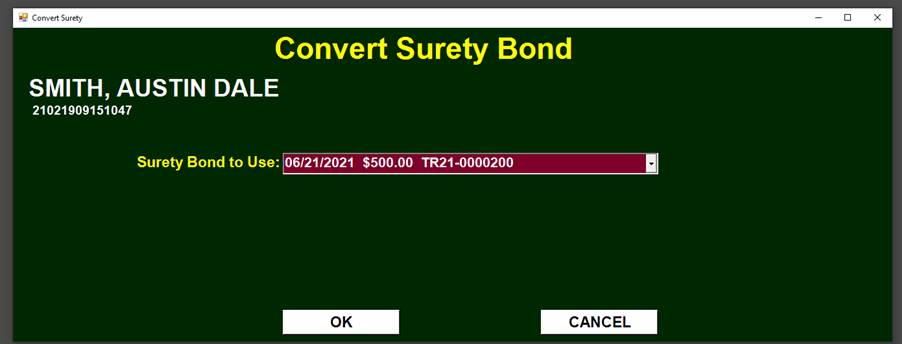

In the Payment Manager the Case Reason is changed to BOND CONVERT SURETY. OK is clicked.

The Surety Bond to Convert must be selected.

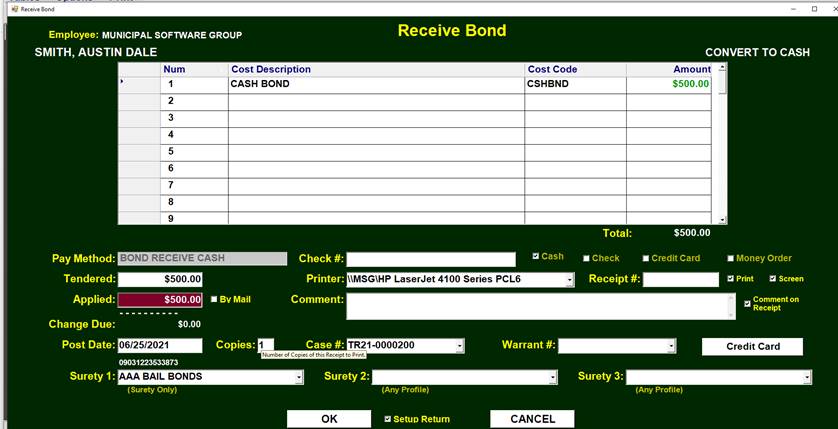

The ‘Cash Bond’ is received.

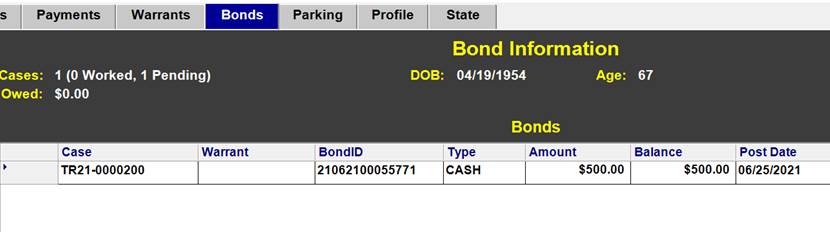

The ‘Surety Bond’ converted to Cash Bond may be observed under the Bonds tab in the history.

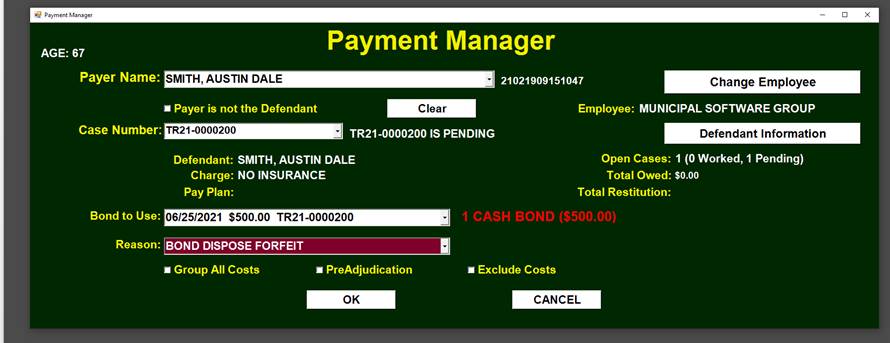

The now Cash Bond is also displayed on the initial Payment Manager.

The Cash Bond is now Forfeited.

The end of the day report will show both the Cash Bond coming into the Bond Account and then the Forfeited Bond coming out of the Bond Account. A normal Cash Bond would be taken in one day and Forfeited out on a later date. This process happens on the same day for a Surety Bond that is converted to a Cash Bond.